Frequently Asked Questions

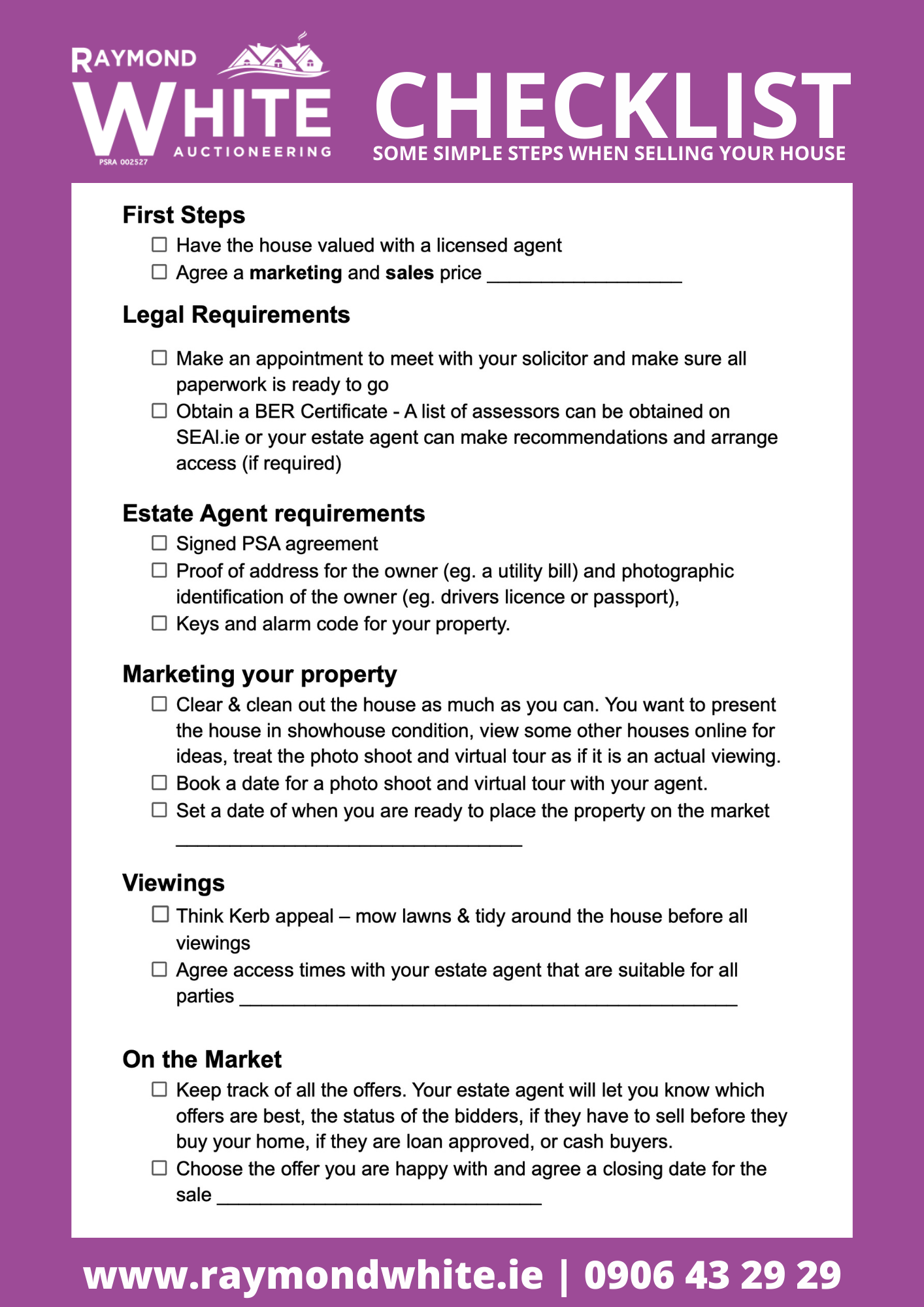

What steps do I follow to sell my house?

Selling a home or property is something that is done up and down the country almost every day of the week. It doesn’t have to be over complicated once you have everything in order.

- The first step is to have the house valued with a licensed agent. Check the local property websites and daft.ie to see who is the most proactive agent in your area. Local knowledge is key. It is advisable to have 2 local Auctioneers value the house.

- Make an appointment to meet with your solicitor and make sure the all paperwork is ready to go.

- Choose a licensed reputable auctioneer that you feel comfortable with, and you feel has valued your property at a price that is market competitive.

- Set a date of when you are ready to place the property on the market and sign paperwork with your auctioneer.

- Get your BER – The Energy rating of the house, all houses for sale in Ireland must have one of these.

- Clear & clean out the house as much as you can with your siblings and remove any sentimental items that you or your siblings would like to keep.

- Book a date for a photoshoot and virtual tour with your agent. Present the house to the best of your ability, view some other houses online for ideas, treat the photoshoot and virtual tour as if it is an actual viewing.

- Think Kerb appeal – mow lawns & tidy around the house. Remember this is usually the first image a prospective buyer will see, either online or when they arrive to view the property for the first time.

Download our check list here

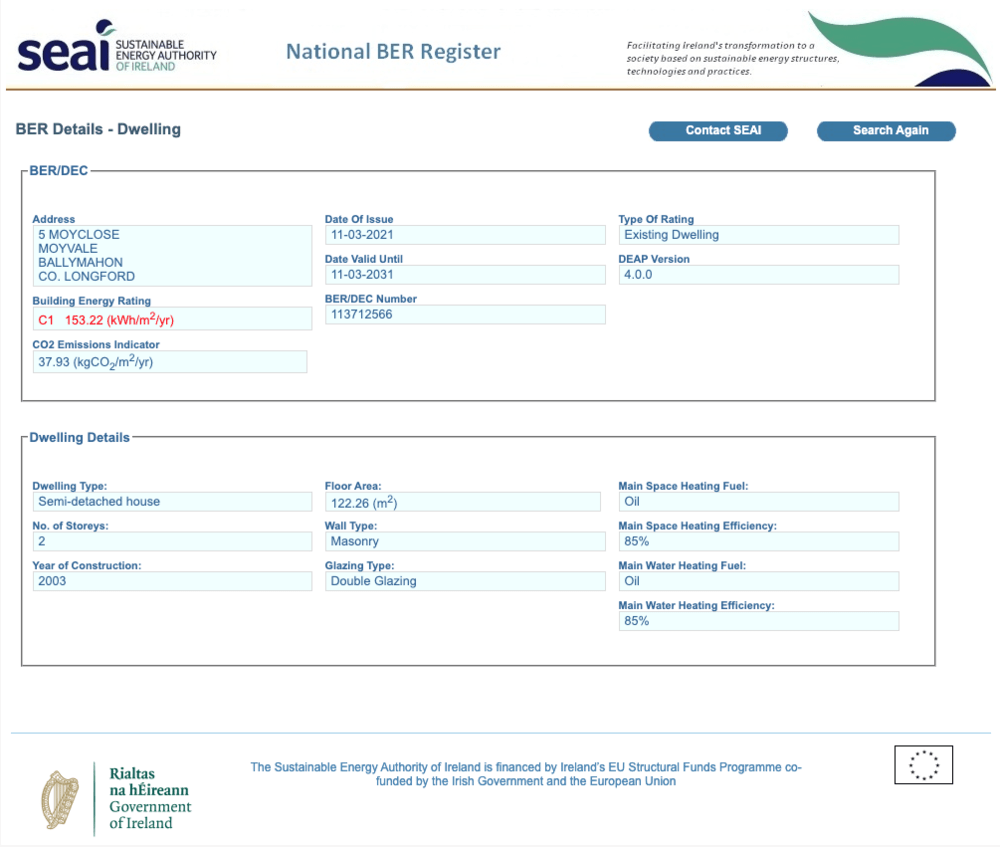

What is a BER?

BER certs are similar to the energy label for a household electrical appliance like your fridge.

the label has a scale of a-g. a-rated homes are the most energy-efficient and g the least efficient. a ber certificate is compulsory in all homes.

If you are buying or renting a new house or apartment now, A BER should be supplied by the agent or landlord – so do ask the seller/landlord or their agent for it.

Since 1st of January 2009, a ber certificate is compulsory for all homes being sold or rented. it is an offence for persons not registered with sei as ber assessors Ireland to purport to carry out a BER assessment service for the purposes of the regulations. there is a maximum fine of up to €5,000.00 for not having a ber cert when required. www.seai.ie for more information

What is the PRTB?

The PRTB was established in September 2004 to operate a national tenancy registration system and to resolve disputes between landlords and tenants. as part of its remit, the PRTB also provides policy advice to the government on the private rented sector. the PRTB dispute resolution service replaces the courts in relation to the majority of landlord and tenant disputes. please note that in order to provide a fair and neutral service to both parties, the PRTB cannot provide legal advice or specific guidance to either case party in relation to their dispute.

Contact Details: The Private Residential Tenancies Board,

PO Box 11884,

Dublin 2

TEL: +353 1 8882960

FAX: +353 1 8882819

E-MAIL: prtb@environ.ie

WEBSITE: www.prtb.ie

What are the revenue and tax implications for landlords?

Rental income is computed on the basis of the gross amount of rents receivable. a surplus (profit) or a deficiency (loss) is calculated separately for each rental source (see part 4.8.2 (pdf, 23 kb) and part 4.8.14 (pdf, 133 kb) of the income tax, capital gains tax and corporation tax manual). the rental income chargeable to tax is the aggregate of the surpluses as reduced by the aggregate of the deficiencies. rental losses occur when the deficiencies exceed the surpluses.

Rental income from property situated in the Republic of Ireland (the state) is chargeable to tax under the provisions of case v scheduled taxes consolidation act (tca) 1997.

Rental income from property situated outside the state is chargeable to tax under the provisions of case iii scheduled tca 1997.

In general, the same rules apply for computing income for case v (Irish rents) and case iii (foreign rents) purposes. however, please note that deficiencies from one source cannot be offset against surpluses from the other. nor can Irish rental losses be set against foreign rental income or vice versa.

This guide addresses many of the issues that arise in relation to the taxation of rental income. Hopefully, it will assist you in understanding those issues and in computing your income or losses for inclusion in your annual return of income.

The legislation concerning rental income is found mainly in part 4, chapter 8 tca 1997. This legislation and related guidance notes are available in the tax practitioners section of the revenue website, www.revenue.ie.